In the second blogpost on estate management, Sian Kilner describes the findings of her research into value for money trends, including how universities are offsetting higher operating and maintenance costs by diversifying their property income base.

Buildings matter to students. When deciding which university to study at, more than a third of students say that they reject institutions because of the quality of buildings, facilities and the physical environment.

This was the outcome of research by the Higher Education design quality forum for the Association of University Directors of Estates (AUDE). It was not an isolated finding. The Times Higher Education Student Experience Survey 2014 found that students rate high quality facilities as one the most important attributes of universities.

That is why it is so important that the HE estate delivers value, both for students and other university users.

A complex resource

The HE estate is unusual in its diversity. Institutions vary widely in size, ranging from some 4,000m² for a small, specialist institution to over half a million square metres for a large multi-disciplinary universities with missions combining teaching and research.

In terms of types of space, on average nearly half an institution’s non-residential space is used for teaching, around 14% for research, and more than 30% for support activities. These averages conceal wide variations, with some HEIs having no specialist research space whereas others have more than 50% devoted to research.

Changes in the estate

Over the ten years from 2003-04, the size of the estate, excluding halls of residence, grew by just over a million square metres from nearly 12.5 million to 13.5 million square metres in 2012-13. During that time, on-campus full time equivalent (FTE) student numbers rose from 1,479,000 to 1,675,000.

Trends in value for money

Following Dr Ghazwa Alwani-Starr’s post describing the higher education estates element of the efficiency review led by Professor Sir Ian Diamond, I have some results from the project that illustrate how the sector is delivering value from its portfolio.

The research led by AUDE for the Diamond Review Phase II has found that HEIs across the sector have delivered increased value for money from the estate over the past ten years through greater efficiency in space use.

1. Income

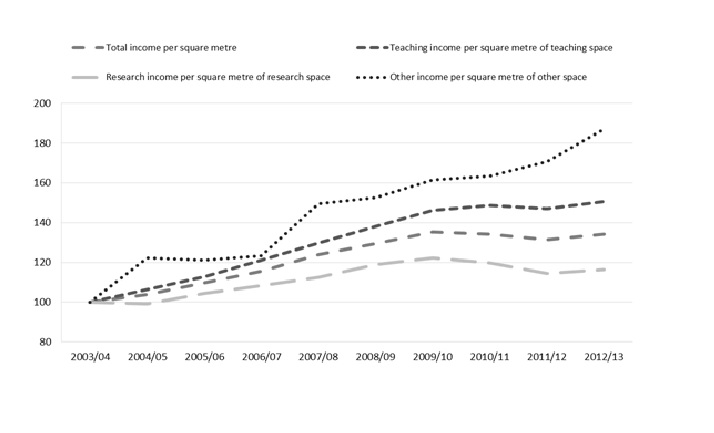

Total income per student and staff FTE increased by 21% in real terms between 2003-04 and 2012-13. Over the same period, however, the ratio of income in real terms per square metre* grew at a much higher rate – 34%, illustrating more efficient and effective uses of the estate

But there were variations in rates of income growth for different types of space. The highest, at more than 80%, was linked to non-teaching and research income, including commercial activities, suggesting that the sector has diversified its income base and its use of space. The lowest rate of growth was associated with research space at just over 16%.

It is important for universities to track these trends when they are planning the long term financial sustainability of different types of space within HEIs. The trends also highlight the need to ensure that, where possible, research space is versatile and can be shared by different uses and users.

Income indicators – sector wide trend over time (weighted average)

Note: 2003/04=100 for all series. All income series are adjusted for inflation.

Source:London Economics based on EMS data

2. Costs

Premises’ operating and maintenance costs per square metre have also risen, up by 26% in real terms over the ten year period, mainly as a result of two factors: increased spending on maintenance to improve building condition and the rise in the cost of utilities. At the same time, there are growing pressures on operating costs from the move towards more highly serviced research and interactive learning and teaching environments.

Property costs per student have also risen in real terms, but at a lower rate (just over 15%) compared with the cost per square metre because space is being used more efficiently now than it was in 2003-04.

Challenges for the future

The research found positive trends in key indicators of value for money from the estate, but there are major challenges ahead.

These include achieving a balance between cost control while still spending and investing at the level required to deliver an estate which is fit for purpose and can be reconfigured and renewed to respond to developments in learning and research practice.

There is also the question of where the capital will come from for investment at a time of declining capital grant funding, the switch to internal resources and the demands on those internal resources from many other quarters as well as the estate.

Sian Kilner is a director of Kilner Planning, which, along with London Economics, carried out the research for AUDE and its partners, Universities UK, the Higher Education Funding Council for England and the British Universities Finance Directors Group, on the estates workstream as part of the Diamond Review Phase II.

For an introduction to the value and role of the higher education estate and other posts from the workstream see our HE estates index.

_______________________________

* Net internal area of the non-residential estate